Regional Taxes & Quote Layout Customization

Release notes

Release notes

v0.3.3 Regional Taxes & Quote Layout Customization

Added: Define default taxes by shipping region (e.g. Spain, USA)

Added: Override default regional taxes for individual clients

Improved: Tax dropdowns now filter based on shipping address

Enhanced: Quote/order items auto-select correct tax rate

Added: Customize quote layout and PDF output

Added: Option to remove client business name from payment section

Added: Display requester (client) name in PDF

Added: Define and show separate Headquarters address

Added: Insert custom notes (e.g. tolerance policies) below quote total

v0.3.3 Regional Taxes & Quote Layout Customization

Configure Taxes by Region. Control How Your Quotes Look.

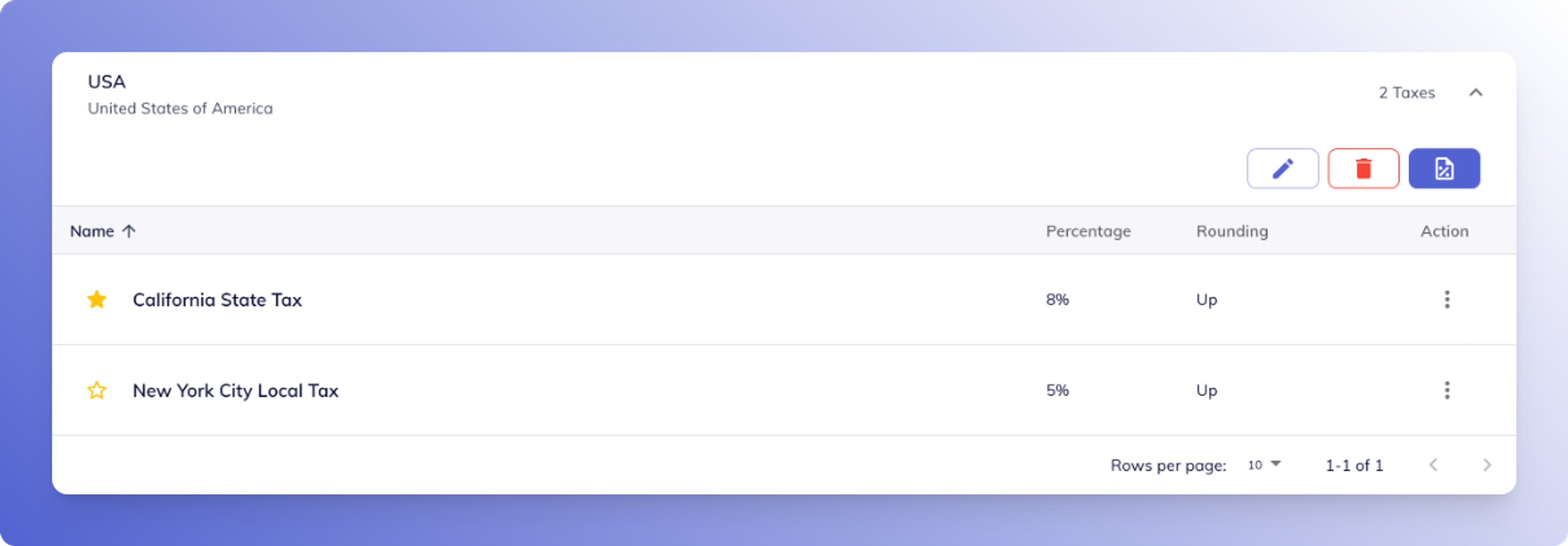

Regional Tax Setup

Enable suppliers to define taxes per region

Now, suppliers can set a default tax rate—like “California State Tax” at 8% or “New York City Local Tax” at 5%—based on the shipping address’s region.

- Suppliers: Enter region-specific tax percentages once, and reuse them across quotes and orders.

- Clients: Get consistent, accurate tax rates automatically in every order form.

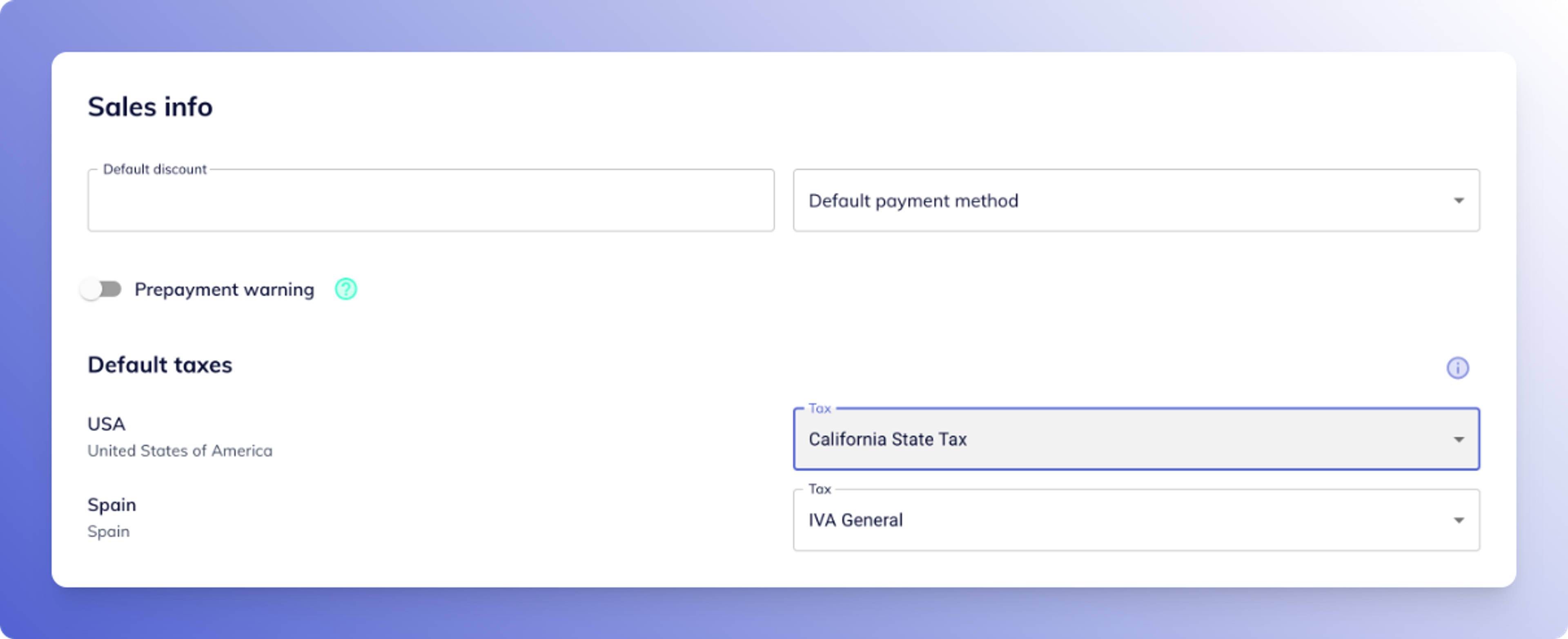

Client Override of Region Default

Allow supplier-defined exceptions per client

Suppliers can override the default regional tax for individual customers—useful for nonprofits, bulk partners, or special agreements.

Once overridden, that client always sees their custom rate when their region matches.

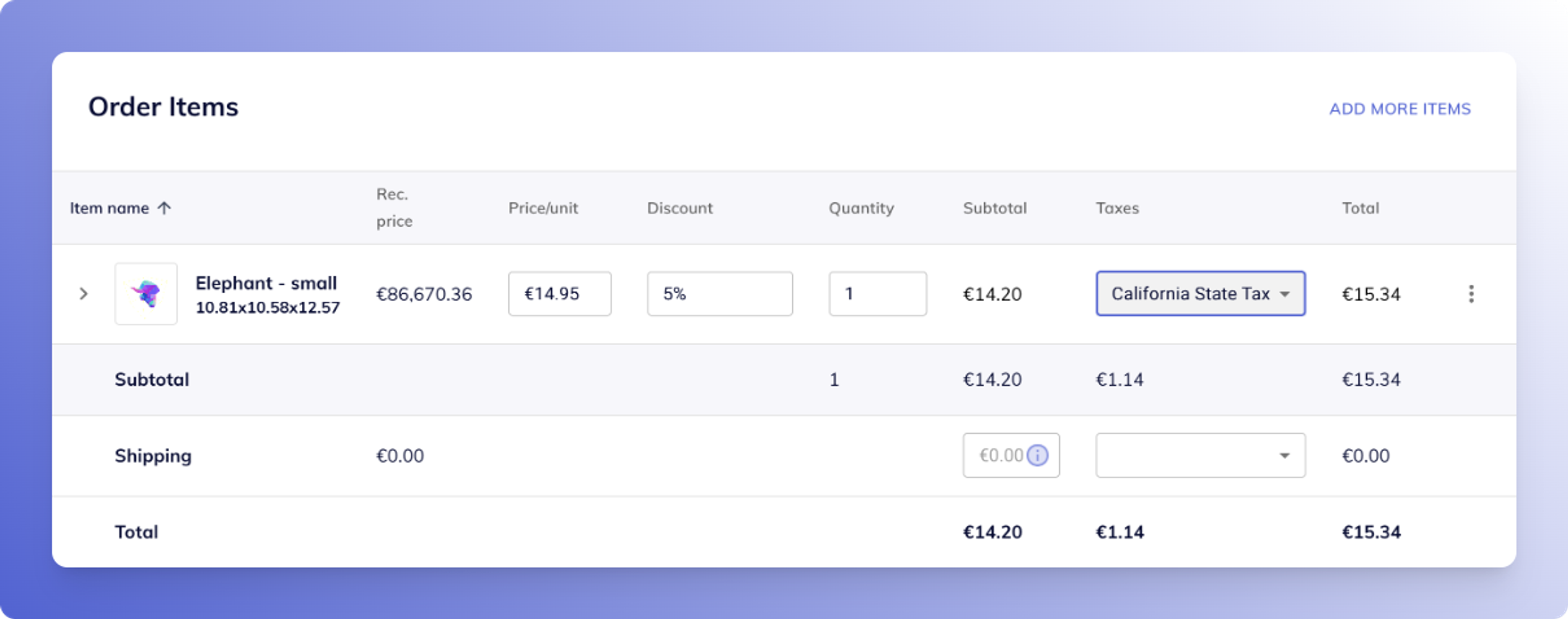

Dynamic Tax Selection in Quotes & Orders

Tax options update based on shipping address

When creating or editing quote/order items, only taxes relevant to the shipping region appear in the tax dropdown.

And the default tax is automatically selected—either the region’s default or the client’s override.

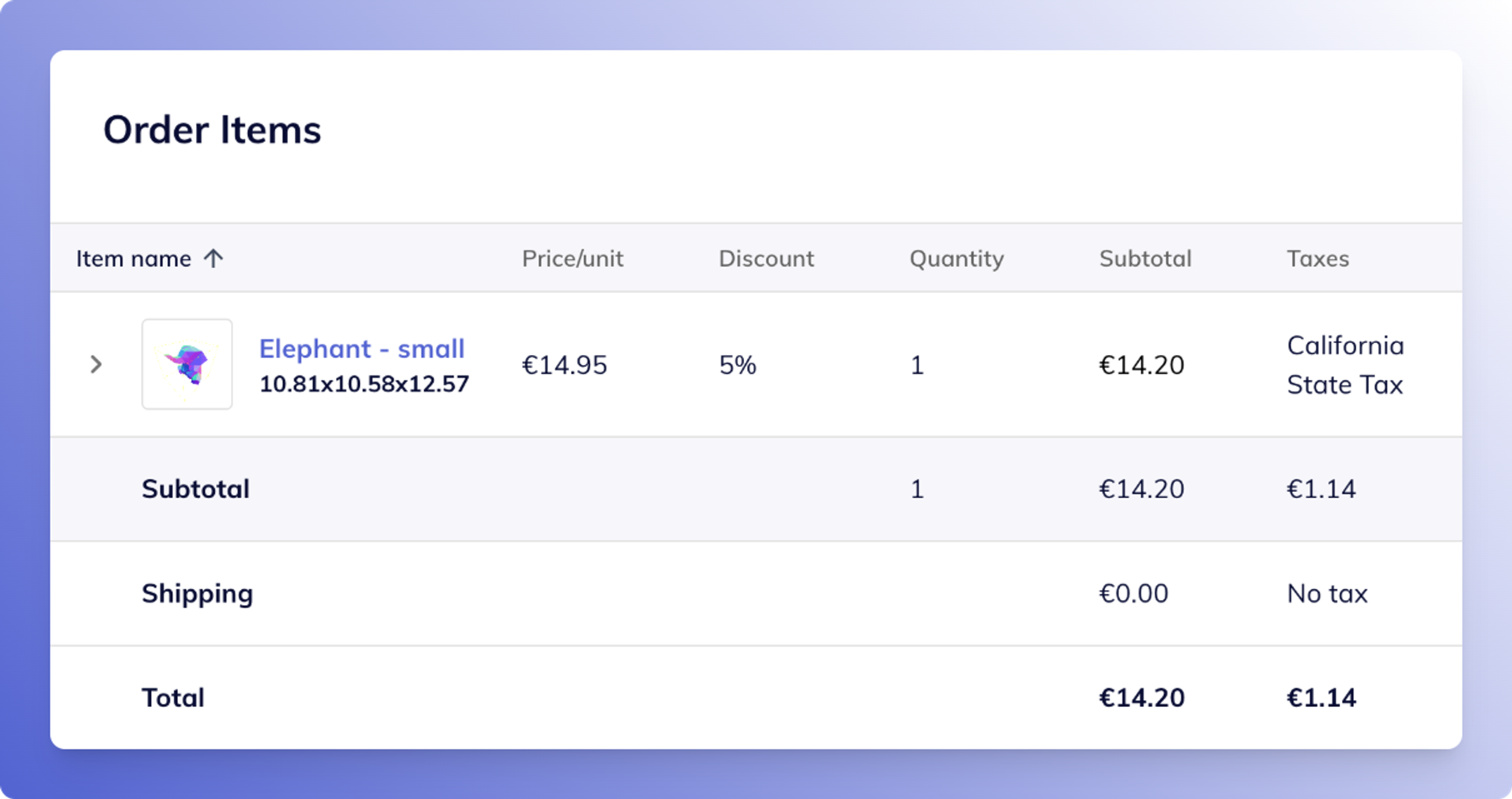

Consistent Client‑Side Experience

Taxes auto-update for clients in real time

Clients get taxes assigned transparently based on supplier configuration:

- When they configure shipping addresses in quotes or orders, the correct tax rate appears and is recalculated.

- Any change in address or supplier tax setup updates the tax field in real-time.

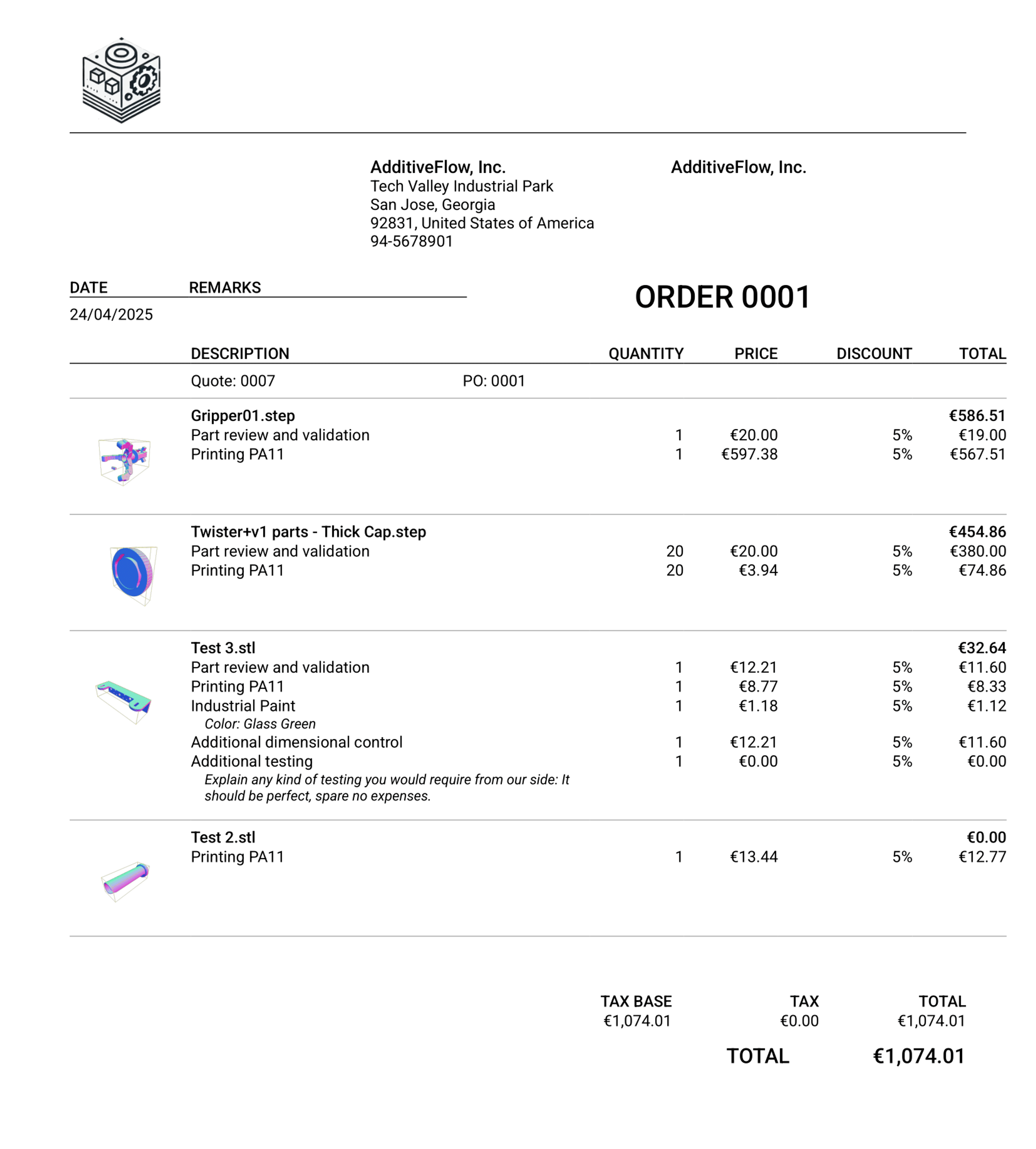

Quote PDF Layout Customization

Tailor the layout to fit your brand and workflow

Suppliers can now configure the structure of their generated quote PDFs. Choose what sections appear, and add organization-specific details to increase clarity and professionalism.

- Hide client business name from the payment section if it’s not relevant

- Add a custom footer below the total for things like tolerance disclaimers or legal notes

- Display requester name clearly, so clients know who initiated the quote

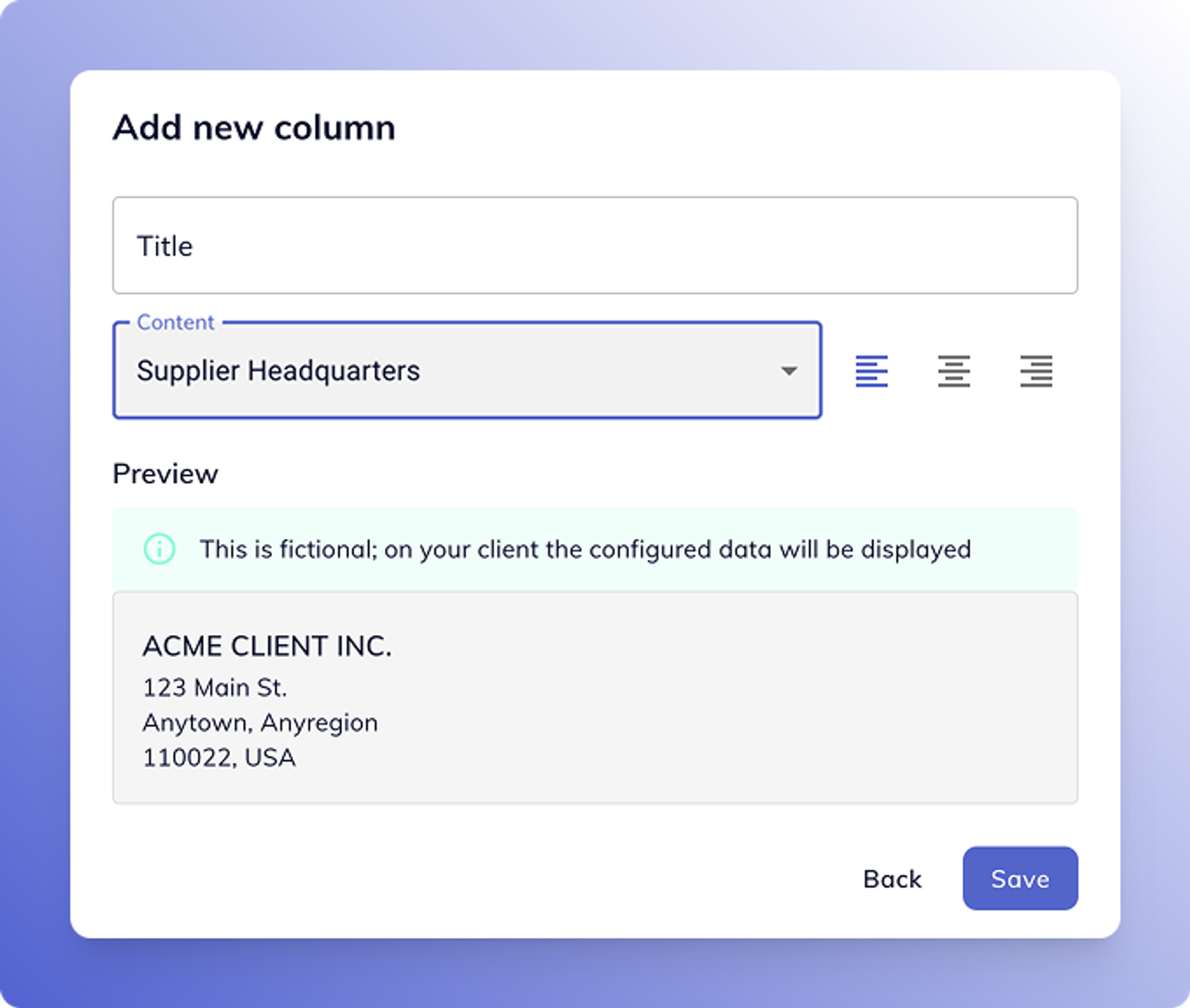

HQ Address Support

Add a separate headquarters address for documents

Some businesses operate with different legal, billing, and HQ addresses. You can now define a Headquarters address, which will appear at the bottom of the PDF, centered — separate from the legal or billing info.

Why It Matters

Accuracy

- Supplier Perspective: No more tax misalignment — always regionally correct

- Client Perspective: Tax is applied transparently and automatically

Flexibility

- Supplier Perspective: Override defaults for specific agreements or clients

- Client Perspective: Always see what’s tailored for you

Efficiency

- Supplier Perspective: Less manual config, faster quote/order creation

- Client Perspective: No more errors or unclear documents